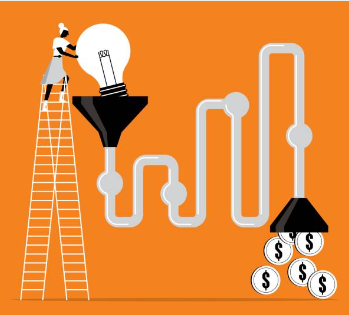

For decades, raising capital meant working the phones, hosting in-person meetups, or hoping your reputation did the talking for you. Today, syndicators are finding the most traction through a marketing funnel built specifically for attracting accredited investors online.

This isn’t about hype. It’s about clarity, structure, and an automated system that works while you sleep. A well-constructed investor funnel guides potential investors from that first moment of curiosity through decision-making and nurturing those relationships. If you’re raising under Reg D Rule 506(c), it’s no longer optional. It’s the only good game in town.

Let’s walk through what that funnel actually looks like, how each stage works, and why syndicators using it are quietly outpacing their competitors.

First, a Quick Reminder: What Is an Accredited Investor?

Before we go deeper, it’s important to define who this funnel is built for.

Under SEC rules, an accredited investor is someone who meets specific income or net worth thresholds. Typically, that means:

-

Earning at least $200,000 individually (or $300,000 jointly with a spouse) in each of the past two years, with a reasonable expectation of the same this year, or

-

Having a net worth of over $1 million, not including their primary residence

There are a few other qualifying categories, like holding certain financial licenses, but the bottom line is this: accredited investors are people the SEC believes can evaluate risk and afford to participate in private investment deals.

Reg D Rule 506(c) allows you to raise capital from these individuals while publicly marketing your offering, provided you follow specific rules, including verifying their status. And that’s where the funnel begins.

Awareness: Showing Up in the Right Places

Every funnel starts with a spark.

For capital raisers, that spark is attention. The first step in your funnel is simple: let people know you exist. But not just anyone, you want qualified prospects, ideally accredited or nearly accredited individuals who resonate with your investment philosophy.

That means showing up where your ideal investor is already paying attention. Maybe it’s YouTube. Maybe it’s LinkedIn. Maybe it’s a podcast. Ultimately, you’ll need to put yourself out there to make sure that people know who you are.

It’s not about being everywhere. It’s about being visible, consistent, and relevant in the right places.

This is where short-form video, educational posts, and interviews come into play. At this stage, you’re not pitching a deal. You’re positioning yourself as a guide. A voice of confidence in a world full of noise.

Discovery: From Interest to Introduction

The discovery stage can begin with a lead magnet (like a guide or e-book) or it starts with a webinar.

That’s your moment to tell your story. Not just what you’re raising for, but who you are, what your investment philosophy looks like, and why your approach to real estate or asset selection is different. The goal isn’t a fast sale. It’s building trust. You’re building familiarity, sharing your values, and creating space for the right people to lean in.

Always remember that investors want to invest with those that they know, like, and trust!

After that first exposure through a webinar, a natural next step is a one-on-one introductory call. Not to pitch a deal, but to get to know the prospective investor and invite them to get to know you. It’s about alignment, not pressure.

By the time you’re having that first conversation, the prospect has already seen your face, heard your voice, and felt your mindset. That matters. It lays the foundation for what comes next.

Too many syndicators try to skip this. They go from a social post to a pitch deck. But high-trust capital raising isn’t transactional. It’s personal. Discovery is where that relationship begins—not just with your offering, but with you.

Relationship Nurturing: The Long Game of Investor Readiness

For many accredited investors, the decision to invest doesn’t happen in a single conversation. It’s built over time.

That’s why the most important part of your funnel isn’t the webinar or the pitch deck. It’s what happens in between.

Drip marketing means providing ongoing value through regular communications. In today’s world, that often means a newsletter going out every few months. However, a better practice is to send weekly reminders and stay top of mind with investors while providing value every step of the way.

Keeps the connection close. Weekly emails, thoughtful newsletters, and investment opportunity updates aren’t just about chasing a deal. They’re about showing up consistently with something valuable to say. You’re offering insights on the market. Sharing your perspective on economic shifts. Letting prospects know what you’re doing to be successful. Give them a look at what you’re building behind the scenes. Not to impress them, but to include them.

The real goal is staying relevant and remembered.

This isn’t passive. It’s proactive credibility. So when you have a new deal in front of you, you’ll also have a list of prospective investors to follow up. Getting your deals funding more methodically and quickly.

And the best part? It’s scalable. With the right system, your email marketing can build real relationships at scale. That means warming up hundreds of leads without burning out your time on constant phone calls.

When Connection Turns into Commitment

The investment doesn’t happen in a certain moment. It happens through the relationship-building process. This relationship looks more like a conversation than a used car salesman-style close.

By the time a prospect is ready to consider an investment, they’ve watched your webinar, taken your intro call, and spent some time getting to know you, your industry, and your business.

They’ve had space to reflect, ask questions, and explore your model without pressure. When the timing is right, the prospective investors will be ready to invest.

The investment sale isn’t as simple as a yes or no. It’s a quiet confidence: I trust this operator. I understand this strategy. I believe in this team.

And when that alignment happens, the rest falls into place. Deal materials get reviewed. Questions get asked. Verification gets handled. But the real decision happened long before that—because you invested in the relationship first.

This Isn’t Just Marketing. It’s a System for Raising Capital.

Let’s be clear: this kind of funnel isn’t just about capturing attention. It’s about building a repeatable, scalable, compliant system for attracting, educating, converting, and retaining investors.

In today’s world, having a great deal isn’t enough. You need to be findable. You need to be trustworthy. You need to meet investors where they are, online, mobile, curious, and cautious.

And once they find you, you need to give them the kind of digital experience that reflects how seriously you take their money and their time.

The best part? Once your funnel is in place, it works even when you’re not. The content runs. The emails go out. The leads come in. Your job becomes showing up for qualified conversations with people who already know what you’re about.

Want to Build a Funnel That Attracts the Right Investors?

If you’re raising capital under Reg D and want to build a compliant, professional funnel that actually works, we’ve created a resource to walk you through it.

Download our free Investor Attraction Playbook for 5 Proven Steps to Consistently Attract High-Net-Worth Investors.

It’s packed with frameworks, funnel maps, and marketing insights from real operators who’ve raised millions, and want to help you do the same.

The future of investor marketing is already here. Let’s make sure you’re not missing it.