Unlocking Real Estate Success: How Hard Money Lenders Can Fuel Your Projects

Every real estate developer and syndicator eventually runs into the same wall, needing money. You find the perfect property, line up contractors, and even start mapping out the business plan. But when it comes time to fund the deal, traditional financing doesn’t always come through. Banks take months to respond, underwriters throw in new conditions, […]

How Positioning Supports Your Brand When Raising Capital Under Reg D 506(c)

Most syndicators and fund managers treat “positioning” like window dressing, nice to have, but not critical. That mindset is costing them millions in investments. When you open the door to raising capital under Reg D 506(c), you’ve already entered a new game. You’re no longer whispering your deal to a tight circle of pre-existing relationships. […]

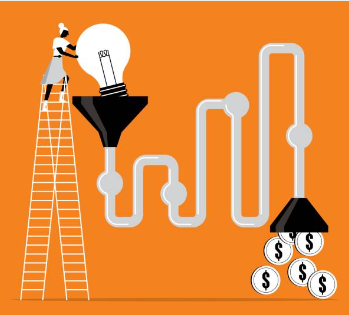

Building Investor Funnels That Work: How Reg D Syndicators Attract and Convert Accredited Capital Online

For decades, raising capital meant working the phones, hosting in-person meetups, or hoping your reputation did the talking for you. Today, syndicators are finding the most traction through a marketing funnel built specifically for attracting accredited investors online. This isn’t about hype. It’s about clarity, structure, and an automated system that works while you sleep. […]

From Spark to Signed Check: Building Your Investor Funnel to Raise Capital with Confidence

Raising capital isn’t just about finding investors. It’s about taking them on a journey. In today’s competitive investment, you can’t simply post a deal and expect the right people to line up with their checkbooks open. You need a system, a repeatable process, and an intentional approach to move people from curiosity to investment commitment. […]

Beyond the Words: Decoding the Hidden Language of an Investor’s Voice

On a phone call, an investor’s voice is your primary source of non-verbal information. Their words tell you one story, but how they say them can fill in crucial gaps, or even tell a completely different tale. Let’s break down what you should be listening for. One of the first things to lock onto is […]